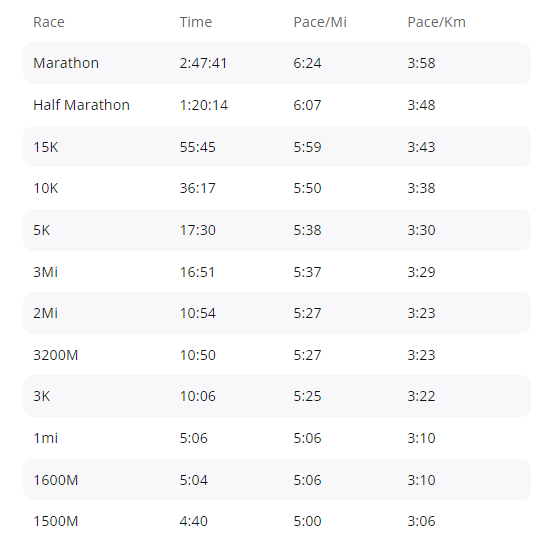

Balanced running extends beyond sheer physical strength. It’s the art of harmonizing different aspects within running. For my mathematical enthusiasts, this all began with American exercise physiologist Jack Tupper Daniels and his formula to V.O2 max training. Jack’s findings tell us a 17:30 5k is the equivalent fitness to a 5:06 mile, along with various other distances outlined in the table below.

How can one achieve balanced fitness across all various distances? It begins with physical training, allowing for rest and recovery, building mental resilience, and consistent diverse workouts over the long term. Achieving equilibrium in workouts involves balancing speed, endurance, and strength. Mental toughness begins with managing our expectations, embracing our current reality, and avoiding false confidence.

Although being a well-balanced runner contributes to long-term success, so does the significance of diversifying and balancing your financial portfolio. Similar to those diverse workouts over the long-term, a diversification of investments across different asset classes, industries, and geographic regions is recognized to lower overall investment risk. The principle is that with a range of investments, the underperformance of one could potentially be balanced out by the better performance of another. Thus resulting in a more consistent overall return. While it doesn’t assure immunity from losses, diversification stands as the pivotal element in achieving long term financial objectives while reducing risk.

Of course delayed gratification is a lesson we can apply when aiming towards a balance in running and financial success. A great marathon season was crafted 8 months in advance. The master of delayed gratification doesn’t let the frustration of not having immediate gains throw them off. Instead, they’re focused on the accumulation of the long term. Good results take time, so let the consistency compound!

If you or someone you know are interested in learning more on the importance of a diverse financial portfolio, our advisors at JGUA have over 45 years of experience following that balanced approach. Contact us today to set up your free financial consultation by calling 800-936-3785 or emailing [email protected].