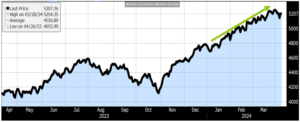

The stock market continued its robust performance in Q1 2024 driven by big technology stocks with Generative Artificial Intelligence investment theses. The overall economy on an aggregate basis has also been strong with unemployment and inflation rates trending lower and now both at 3.8%.

The S&P 500 index reached an all-time high on March 28. The “Magnificent 7” big technology stocks (Amazon, Alphabet, Apple, Meta Platforms, Microsoft, NVidia and Tesla) make up almost 30% of the index weight and are responsible for over half of the Q1 2024 index returns. As stocks have reached high multiples with Amazon and NVidia trading at 64x and 73x Price to Earnings ratios, they now have higher investor expectations of earnings growth.

S&P 500 Index Rallied 10.5% in 1Q24 Driven by Generative Artificial Intelligence

Source: Bloomberg

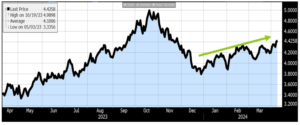

One major factor that can change market dynamics is interest rates as investors gauge whether the Federal Reserve will cut their benchmark interest rate. The 10-year US Treasury bond now yields 4.4%, which is well above its December trough at 3.8%.

10-Year Treasury Yield Has Rebounded After 4Q23 Drop

Source: Bloomberg

With market valuation at historically high levels, key monitoring points that can change the market direction are inflation, unemployment and interest rates.