Mixed Sector Returns in a Strong Labor Economy

The stock market was up overall in January but there were material discrepancies in performance returns from the different market sectors. The Russell 3000 index that covers the 3,000 largest publicly traded companies had a monthly performance of 1.1%. However, the market sector performances had investment returns that were in fact mixed. For example, the Consumer Staples sector had a positive return of 1.3% while the Consumer Discretionary sector had a negative return of -3.7%. This is a sign that investors are concerned about higher credit default rates and potentially lower future discretionary spending.

The Healthcare and Industrials sectors had positive returns last month while the Energy sector had a negative return. In the energy sector, investors are concerned with an oversupplied oil market as global demand for oil has weakened. The Technology sector that makes up 28% weight of the Russell 3000 index is again driving overall stock market returns, had a monthly return of 3.6%. Meanwhile, the Real Estate and Utilities sectors both had negative returns as interest rates remain high due to a strong economy.

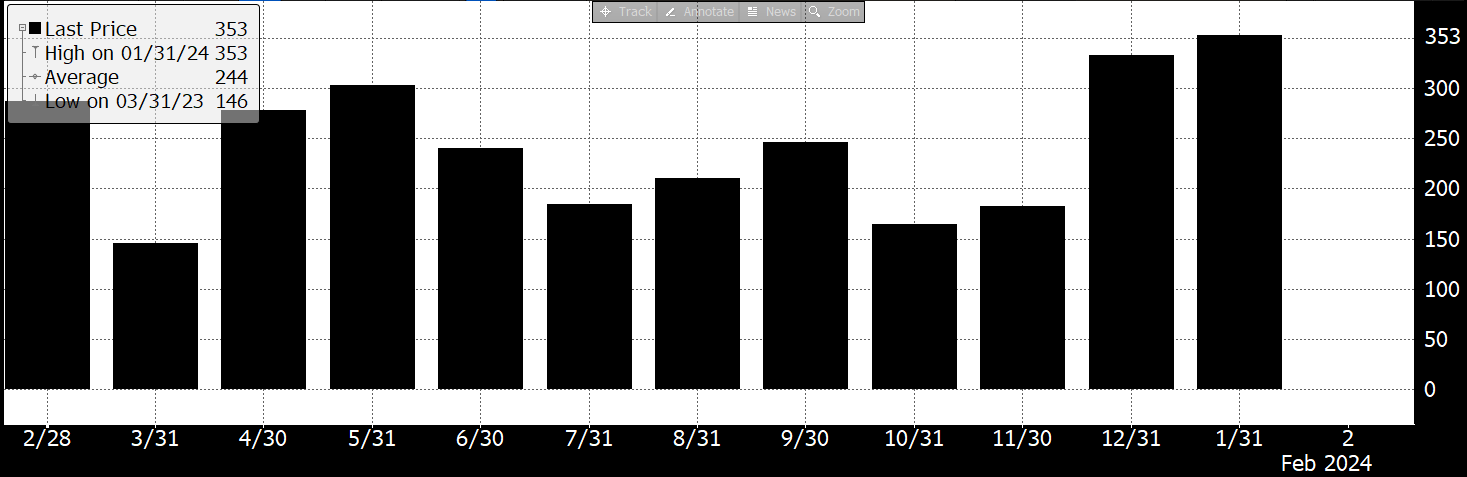

The labor market witnessed an annual high of nonfarm payroll additions in January as they increased by 353,000 with the unemployment rate steady at 3.7%. In addition, hourly wages increased the most since March 2022.

Monthly Additions of US Employees on Nonfarm Payrolls

Numbers in Thousands

Source: Bureau of Labor Statistics

Despite mixed sector returns in the stock market, the economy continues to be resilient. Key risks to both the 2024 stock market and global economy include higher inflation rates and unexpected geopolitical events.