An explanation of how a few stocks can drive performance of the S&P 500

Updated on July 27, 2022

By JGUA Research Analyst Mark Abdalla, CFA

Commentary by Associate Advisor Sarah E. J. Collier, JD

The past few years for the stock market have been unique in terms of circumstances, returns and volatility. At John G. Ullman & Associates Inc., we maintain our investment philosophy of identifying securities at attractive valuations with key catalysts for growth. Every stock position at the firm has a Buy and Sell price based on their intrinsic valuation determined through fundamental bottom-up analysis with financial models. At the same time, we have top-down views on different market sectors with their own set of secular trends. The final set of investments of stocks approved by the Investment Committee are in favorable sectors with strong company fundamentals and are purchased at pre-determined prices.

Sectors we currently view favorably include:

- Healthcare, with strong demographic trends and long-term demand;

- Infrastructure: with infrastructure bill passed last year and a backlog of public projects across the United States;

- Technology: as technical innovation is flourishing with many opportunities;

- Utilities: with regional market share to protect their pricing power against inflation.

The John G. Ullman & Associates, Inc. Research Team also considers sectors that are out of favor and therefore have very low price valuations. As our investment focus is long-term, we look for companies that may be facing near-term headwinds but are restructuring with long-lasting value propositions.

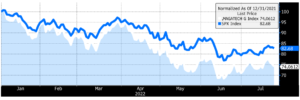

While large technology companies have dominated the overall stock market over the past five years in terms of index weight and outperformance (especially during the pandemic period), the sub-sector has underperformed this year. The largest five companies (Apple, Microsoft, Amazon, Alphabet and Tesla) in the S&P 500 still make up 22% of the overall index but have weighed down stock market performance this year. Market capitalization is a function of stock price and shares outstanding. Big technology stocks have driven index returns and volatility with their large size and unstable price movements. The below graph shows Big Tech stocks declining 26% while the overall S&P 500 index declined 17% year-to-date.

Magatech (MSFT+AMZN+GOOGL+AAPL+FB) vs the S&P 500 Index over 1 year

Source: Bloomberg

Source: Bloomberg

The S&P 500 has seen a correction in valuation with its weighted average Price to Earnings multiple having contracted to 20.5x from 22x last year. A rising interest rate environment combined with a heightened probability of an upcoming recession has added to the high uncertainty of technology stocks that had stretched valuations based on unreasonable earnings growth expectations.

With an investment philosophy based on identifying attractive valuation, one positive note from the increased market volatility is that it does offer opportunities to invest in sound businesses at lower prices. Companies with strong fundamentals and proven business models accompanied by strong free cash flows are more likely to meet our Buy Prices given the market volatility, and come out of the economic cycle trough with increased market share.

~ JGUA Research Analyst Mark Abdalla, CFA

How does this impact your investments, as well as your long-term and short-term financial goals?

Diversification-Are your investments as diverse as you think?

Diversification should be the first thing that comes to mind when reviewing your investment accounts (both managed and non-managed accounts). Those that invest only in individual stocks and bonds might be able to easily determine whether or not their investments are diversified. However, by comparison, many investors like investing in vehicles such as mutual funds which can be more difficult to assess, especially if they are invested in more than one mutual fund. There may be risk of over exposure in certain positions, market segments or asset categories that may make your investments riskier than you realize or are comfortable with.

While an individual mutual fund offers diversity among different stocks and bonds, if you invest in a number of mutual funds, it is not uncommon to see a reoccurring pattern of many of the same holdings owned within them. When this happens it has the potential for you to become significantly overweight in a particular sector or individual stocks. This could appear to be great for your portfolio if those stocks or sectors happen to be performing well, however, this type of exposure also increases one’s risk as well through lack of diversity.

An additional concern with a lesser diversified account is it decreases the portfolio’s ability to weather various economic factors which could have a significantly negative impact. This could further impact an individual’s short-term and long-term financial goals that they have planned for their investments.

Risk vs Opportunity- Which should I decide on?

There is always going to be some risk when it comes to investing, which is why it is important to understand what your risk tolerance is and routinely assess whether your investments’ risk segmentation actively reflect your risk tolerance. While everyone likes the thought of making money on their investments, the question to ask is “What is your ability and willingness to accept a decline in the value of your investments?”

Factors to Consider:

- Emotional stress with investing: It’s important to self-assess whether you are someone who will fixate on the stock market and your portfolio. A simple question to reflect on is “Can you sleep at night or do you worry about your portfolio?” (This not to be confused with being an informed investor which is someone who educates themselves on the positions they hold and follows the stock market).

- Outside influences: This includes influences that affect individual companies and industries on a more macro level such as domestic and foreign politics, the domestic and foreign economies and other catastrophic events (such as the COVID19 Pandemic).

- Investment Horizon: How soon do you plan to need the assets? This discussion typically goes hand in hand with retirement planning, but many earmark their investments for large purchases, charitable gifting strategies, and family gifting strategies.

- Risk Capacity: One of the biggest components in my opinion is analyzing the balance sheet to determine how much an individual can sustain a potential loss from a riskier investment based on their current and future life style.

Here at JGUA, we take a more holistic approach when it comes to investment management. Areas we focus on go beyond the return received. We focus on areas such as tax planning, short/long-term cash flow and retirement needs, charitable gifting strategies, family gifting strategies and legacy/estate planning. We are strategic with the portfolios under our management because each individual client has different goals, risk tolerance, and other financial circumstances that warrant individualized portfolios.

~Associate Advisor Sarah E. J. Collier, JD

Have any further questions on the JGUA investment philosophy, investments, or what type of investing may be a good fit based on your risk tolerance? Contact us at : info@jgua.com.