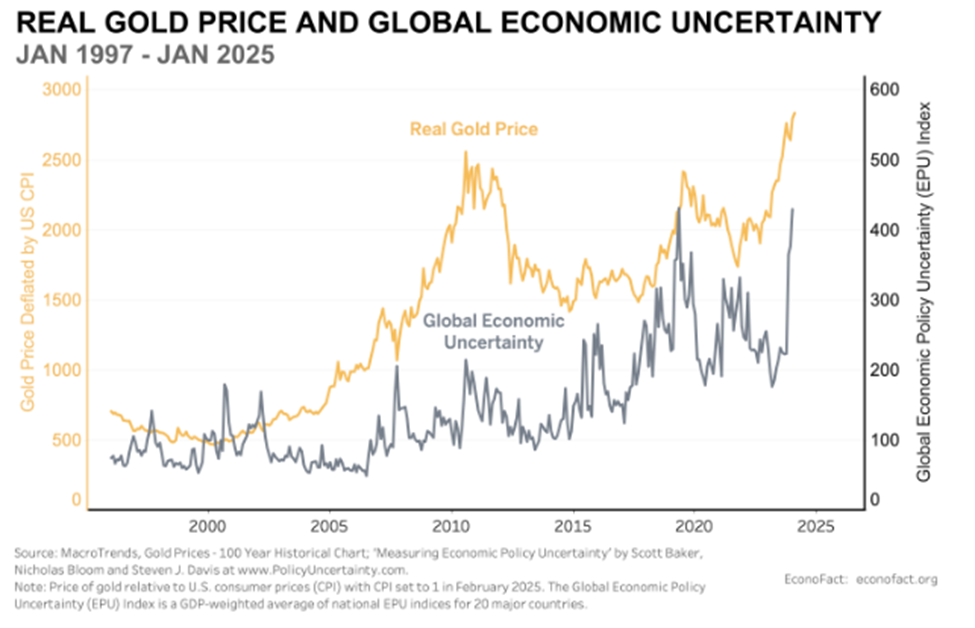

Gold price has been on the rise so far in 2025, it has gained about 29% as of June 5th. In 2024 it experienced a significant rise of 26%. Actually beating the S&P 500 total year return and marking its best annual performance since 2010. This year, we’ve seen a significant increase in the price of gold, driven by the ongoing trade tensions surrounding tariffs and concerns over the growing U.S. debt and budget deficit. Market fears are currently focused on two major uncertainties: the future of global trade with the world’s largest economy, the United States, and how the U.S. will address its growing debt and fiscal imbalance. These two major concerns have prompted some investors to adopt the so-called “Sell America Trade.” This strategy reflects a broader shift in investor sentiment, as both institutional and global investors reduce their exposure to U.S. assets—such as the dollar and U.S. Treasuries—in response to the economic risks and fiscal imbalances outlined above. We saw the “Sell America Trade” unfold in April 2025, marked by a sharp sell-off in both U.S. equities and the bond market. Typically, when investors exit equities, they rotate into safer assets—historically, that has meant U.S. Treasuries. However, the simultaneous decline in both the markets signaled a broader loss of confidence in U.S. assets. As of November 2024, foreign investors hold approximately $8.5 trillion in U.S. Treasury securities, representing nearly 30% of the government’s marketable public debt. Japan is the largest foreign holder, owning just under 13%, followed by China, which holds nearly 9%. One notable move has been a shift into gold. This has led to the rapid increase in the gold price as investors are seeking safety elsewhere over the mounting concerns listed above. We can see below that as global economic uncertainty rises, the price of gold will tend to follow.

In my view, gold is best understood not as a traditional investment, but as a trade driven largely by fear and uncertainty. It primarily serves as a hedge against inflation and a store of value during periods of market volatility and economic stress. Historically, gold has tended to rise in times of uncertainty, reinforcing its role as a sentiment-driven asset. This behavior can make gold a highly speculative asset—as it tends to experience sharp spikes during periods of heightened fear and uncertainty, followed by prolonged underperformance compared to traditional investments like stocks and bonds when markets are more stable. Unlike stocks and bonds, gold does not generate income; it pays no interest or dividends, which limits its long-term compounding potential. Gold has long held a unique allure, partly due to its historical use in jewelry and its former role as the reserve backing for the U.S. dollar under the Federal Reserve System. This doesn’t mean gold isn’t worth including in a portfolio—it can still serve as a valuable diversifier and a hedge against traditional market-exposed assets. If an investor is interested in holding gold as part of their portfolio, it may be more appropriate to consider investing through an exchange-traded fund (ETF). One of the largest and most widely traded gold-backed ETFs is SPDR Gold Shares (GLD). It tracks the price of gold bullion, with each share representing a fractional ownership of physical gold stored in secure vaults. This allows investors to gain exposure to the asset without the challenges of buying and storing physical gold, which can be a sub-optimal investment for individual investors.

*Information presented is for educational purposes only and views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate.*