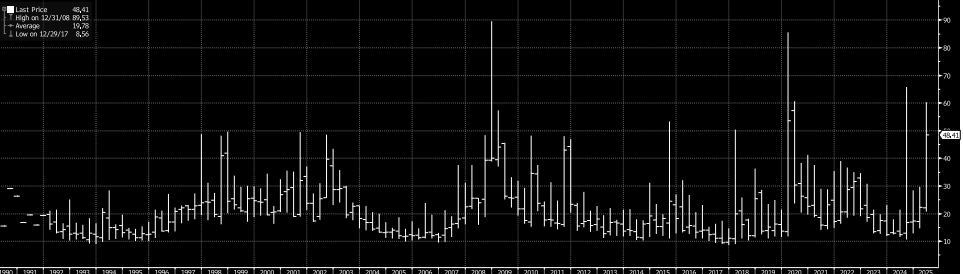

We live in very uncertain economic times that are driving stock market and asset prices violently and unpredictably. Below is the graph of the CBOE Volatility Index over the last 35 years, commonly referred to as the VIX index or the fear index. It’s derived from prices of SPX index options with near term expiration dates, it generates a 30 day forward projection of Volatility or how fast prices change. It’s a good way to measure fear. In normal markets, the level averages 17. Only 4 times in the last 35 years have we exceeded 60 on the index. The financial crises in 2009, COVID in 2020, the Japan Nikkei collapse in 2024 and now President Trump’s tariff announcement. Over the last 5 years we have lived with tremendous stability in the index with levels typically below 15.

April 2nd or Liberation Day, as Trump called it, shocked the world with “reciprocal” tariffs as high as 97% for Cambodia and a low baseline of 10% for most nations. Trump said the U.S. would begin charging a “minimum baseline tariff of 10 percent” on all imported goods, but he said the U.S. would also tariff countries at a rate equal to half of tariff rates that countries charged for U.S. goods, “including currency manipulation and trade barriers.” Most economists and others disputed the accuracy of Trump’s numbers, but it was later revealed that the tariffs rates were determined using trade deficits instead of existing tariff rates.

According to the World Trade Organization, the EU’s trade-weighted average tariff rate is 2.7 percent. Trump said that European countries charge a value-added tax of about 20 percent — it varies by country. Those taxes are levied on imports as well as domestic production, so the VAT does not provide any trade advantage.

The Trump Administration arrived at 39% for the EU by dividing the US imported $605.8 Billion trades’ goods with the trade deficit of $235.6 Billion. However, nearly all economists say that’s a very bad way to attempt to impose reciprocal tariffs for countries.

Following this announcement, the SPX index dropped by 12% (April 2nd to April 8th), the Nasdaq index was down by 13.24%, and the Dow Jones Industrial Average lost 10.8%.

On April 9th, Trump surprised markets again with a 90-day suspension of most tariffs with the exception of China’s duties increasing to 145%. The markets rallied on the relief of the tariffs. The SPX index gained 9.51%, the Nasdaq gained 12.1643%, and the Dow finished ahead by 7.87%.

Investors believe that trade talks will not be wrapped up soon; the uncertainty is already affecting business and consumer sentiment as some companies are canceling orders and many warning that a recession is near. As the market swings every day cased on the newest headlines, many economists and investors are wondering what impact this uncertainty will have on economic activity in general. Is this the beginning of something more unfortunate or will folks just learn to adapt?