Do you like donuts? If the answer is yes, or no for that matter, here is a donut you may not like- the Medicare Donut Hole.

We all know Medicare is complex and confusing. When you start thinking about medications that can make it seem worse. Between the potential deductible, the copays and coinsurances, to what you hear about the donut hole (also known as the coverage gap) and lastly the catastrophic coverage- what does it all mean? Stick around to (hopefully) gain some clarification.

Before we get into explaining what the donut hole actually is, we first need to understand a few key terms in regards to Medicare Prescription plans. If you don’t already know, every medication is put into a Tier level. Most Medicare Prescription plans have 5 tiers of their formulary. Typically, not always, Tier 1 and Tier 2 medications have cost sharing (most times in the form of a copay) without needing to meet your deductible. Typically, tier 4 and 5 are coinsurance driven costs. The difference between a copay and a coinsurance is that a copay is a fixed dollar amount verses coinsurance which is a percentage of the cost.

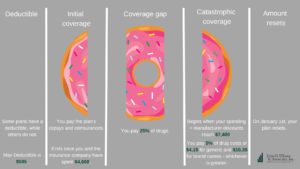

The next thing we should talk about are the four main sections of Medicare Prescription plans: the deductible (if applicable), Initial Coverage, Coverage Gap, and Catastrophic Coverage. Let’s think about a traditional donut when going through this.

- The deductible is the amount you have to pay first, before you get any help for paying for your medications. Again, typically tier 1 and tier 2 are not subjected to the deductible yet tier 3 and above are. The deductible amount depends on the specific plan you choose, but most plans have a deductible. This is the left side of the donut before you take a bite.

- The next section is the Initial coverage- this is the portion of the donut on the left side of the center hole, which is part of your plan that is the cost sharing aspect. In this section, you are paying either a flat copay or a percentage of the cost of the medication.

- The middle of the donut is also called the coverage gap or the donut hole. This is the portion of the plan coverage, where you will typically be paying the most for your mediations. If you get here, the requirement for how much you may pay usually goes up quite a bit for your co-pay driven medications, as you will be required to pay 25% of the drug costs. However, you may see a drop in the coinsurance driven medications- depending on what your coinsurance is during the initial coverage period.

- And the final section of the donut on the right side of the middle hole is called the catastrophic coverage. This side of the coverage is typically when the cost of the medications goes down for the member. In this section, you will be charged the higher of a flat copay ($4.15 for generic or $10.35 for Brand Name) or 5% of the cost of the drug.

The final thing to understand is when you will move into each section. Let’s look at some numbers together:

- The deductible portion would depend on if your plan has a deductible or not- kindly note that most plans do. For 2023, the max deductible is $505.

- The initial coverage period will end when you and your insurance has collectively paid $4,660. You may hit this faster if you have more expensive medications, but remember that this is a total amount paid by both the insurance company and the member combined.

- The donut hole is where you will pay 25% of the medication cost. Although you do not see it, per Medicare, the manufactures of medications are provided a discount of up to 70% of the cost. The discounted amount plays into when you will come out of the coverage gap and into the catastrophic coverage.

- You will enter the catastrophic coverage portion when your spending and the manufacturer discounts total $7,400. Once you get in the catastrophic coverage, the cost of your medications is the greater of a flat copay ($4.15 for generic or $10.35 Brand Name medications) or 5% of the drug cost. You would then be in this portion for the remainder of the year.

Kindly note that everything, including deductibles and amounts you paid out of pocket, restart on January 1 each year. Therefore, if you enter the donut hole in September, then you go back to the start of the donut (deductible/initial coverage period) the start of the New Year.

We know that Medicare is very confusing and complicated. If you have any questions or would like to review options during open enrollment, we invite you to talk to an advisor.