Poor Whiskey (my sweet 17-year-old paint) has been lame on and off for the last year. We went through various diagnostics and treatments to identify the origin of the lameness. Nothing found was remarkable. Isn’t that how it goes though? Going through the various sessions with my vet made me realize just how fragile their system can be. If they are exhibiting lameness in the front limb, there might be nothing wrong with that limb. Instead, the identified lameness could be a result of stress from overcompensation for other sources of pain such as hock, back, etc. These other sources may be singular and a direct cause, or numerous and indirect (often unraveling like an onion until you find the root cause).

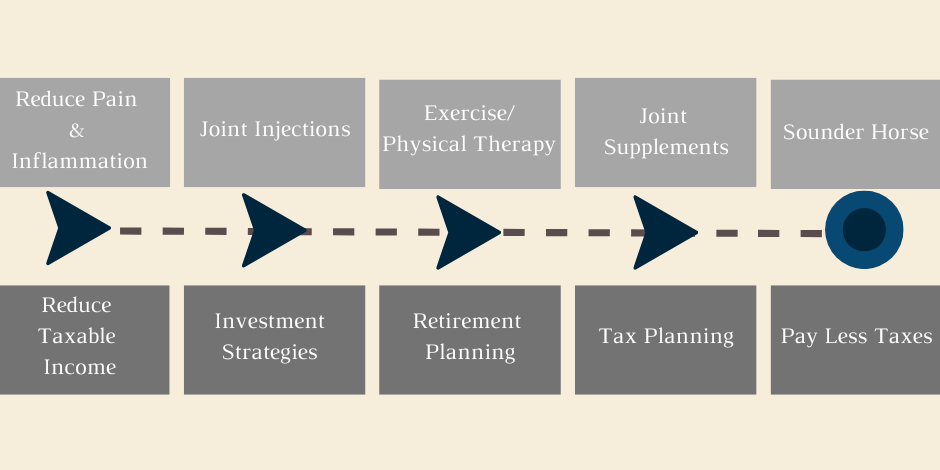

This reminds me why it is so important to work with a financial advisor to create a thorough financial plan. Our financial health is so reliant on various aspects of personal financial planning. Without someone putting together the pieces, you can become financially “lame.” One notable example is coordinating investment strategies, retirement planning, and tax planning to reduce tax liability. By taking a holistic approach and incorporating these three areas, an individual may be able to reduce taxable income, (i.e. pay less taxes). Just like no one wants their horse to turn up lame, no one wants to unintentionally pay more in taxes. However, failing to implement one strategy may impact the end result.

The illustration above demonstrates how implementation in one aspect of equine wellness/financial planning might affect achieving a target goal. For example, exercise and physical therapy can have a profound impact on improving a horse’s lameness depending on the root cause. The tradeoff is it takes time and dedication to follow a regimen as recommended by a vet. Failing to follow a recommended regimen could have long-term effects on your horse’s soundness and may require frequent costly treatments when they age to keep them comfortable. Similarly, retirement planning is a long-term plan that can be part of another goal based on the client’s objectives. We all too often think that we can avoid making contributions in one year to play catch up in the next. Just like skipping one day or one week of your horse’s physical therapy can impact the holistic treatment to improve their soundness, not planning for retirement can impact your financial health. For example, not making pretax contributions in your retirement account may result in you paying more in taxes, and you will not have that years’ worth of contributions or future compounded earnings in your retirement account.

Of course there are always exceptions, which is why it is important to understand the “red flags” proactively. With Whiskey, it is important to have a great relationship with a qualified vet that takes a holistic approach to improving soundness. With personal finances, it is important to have a qualified financial advisor that takes a holistic approach when looking at your finances and assessing plans to achieve goals.

Working with a financial advisor that coordinates the various aspects of your financial health should ground you and make things more predictable to preserve your financial plan. Interested in working with me or one of our other advisors here at JGUA? Contact us at…

*This blog should in no way be construed as veterinary advice. Any references to veterinary horse lameness examinations and treatments were based on my personal experience.