You hear it all the time, “retirement must be coming soon, huh?” or, “when are you going to hang it up?” You may have a retirement age picked out, or not know when you are going to retire at all. When asking yourself, “Am I in the ballpark for retirement?” it is important to base your answer off well-thought-out projections instead of just picking an age that sounds good to you. Here are seven key tips to ensure a comfortable future:

- Create a Balance Sheet

Start by gathering information on the amount of assets you, or you and your spouse, may have. This is usually done through the creation of a balance sheet, or a “snapshot” of your current financial situation. Include:

– Cash accounts: checking and savings accounts.

– Invested assets: investment accounts set up through a broker, or retirement accounts like a 401(k) or an IRA.

- Determine Accurate Values of Your Accounts

It is important to have accurate values of these accounts to create an accurate retirement projection. Regularly update these values to reflect the current market conditions and account balances.

- Consider Retirement Income Sources

An important piece of the puzzle will be the income you expect to receive during retirement. The items listed below, along with your investment and retirement accounts, will make up the nest egg that you will plan to live off of during retirement.

– Social Security

– Pension plan income

– Annuities or other steady income sources

- Account for Taxes on Withdrawals

Consider whether your invested assets have been taxed yet. If they haven’t, you will want to account for the federal and state tax on withdrawals during retirement. This ensures you have a more accurate picture of your net income.

- Calculate Your Cost of Living

Calculate your cost of living, or a yearly budget. This is often the hardest part for most people. Make an honest assessment of how much money you spend on certain items over the course of a year by:

– Gathering all of your credit card and bank statements.

– Categorizing and totaling your transactions.

– Breaking down these categories into monthly or weekly numbers.

Think to yourself, “is this number accurate? Do I really spend this much on groceries, shopping, etc.?” And don’t forget to leave some room in your budget to treat yourself to that vacation!

- Assess Your Retirement Equation

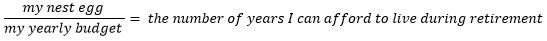

Following the creation of your “yearly budget,” you get to take a trip back to high school and complete the following equation:

The answer to this equation combined with the age you expect to live until will be your answer to the question “Am I in the ballpark for retirement?”

- Make Adjustments as Necessary

If the number of years your nest egg can provide for you isn’t quite what you were expecting, you can make adjustments to improve your outlook. This is when an honest self-evaluation comes into play. You have to ask yourself, “can I realistically cut my yearly budget down to increase the number of years my nest egg can provide for me, and will this get me to my goal? Or should I continue to work and add to that nest egg in order to reach my goal?”

This is where financial planning and expertise can help tremendously with figuring out whether or not you are in the ballpark for retirement! Use these seven key tips to ensure you’re on the right path to a comfortable future.