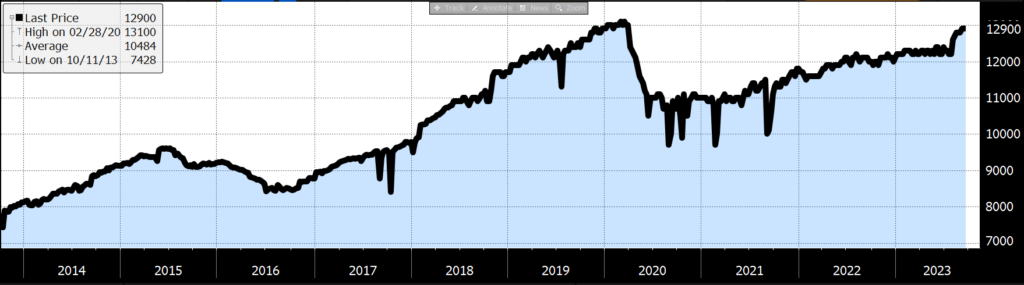

Up until September, the stock market had been having a great year rebounding 15% from the bear market of 2022. Then September came and the S&P 500 index dropped 5%. The narrative from investors changed from “peak interest rates” to “higher interest rates for longer” to “higher interest rates forever”. This new environment is reflected in the 10 year Treasury yield that increased dramatically in September from 4.2% to a high of 4.7%.

Under the Pure Expectations theory, longer term bond yields are a guide on where short term interest rates are heading. As the 10 year Treasury yield is now double its average of 2.3% over the last 10 years, it is clear the market is anticipating a restrictive monetary policy. This is due to inflation being stickier than previously thought as the Consumer Price Index ticked upwards to 3.7%, well above the Federal Reserve target of 2%.

Inflation is up partially because the price of oil rallied which impacts the cost of transportation and final prices of many goods. US oil companies have responded to the price increase by producing more at 12.9 million barrels a day while exporting 4 million barrels a day. This helps to fill some of the global supply void from production cuts in Saudi Arabia and Russia. That said, the number of rigs searching oil in the US has contracted by 20% since November (according to data from Baker Hughes) and sets up volatility in the energy market.

US Production of Oil

(In Thousands of Barrels of US Oil Production)

Source: Department of Energy

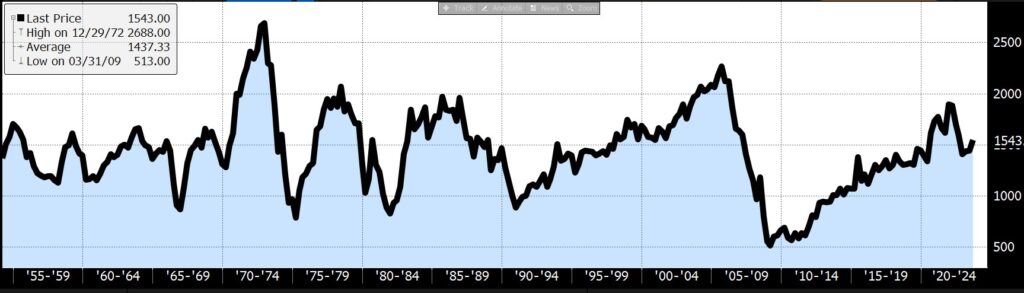

The Leading Economic Indicators as defined by the Conference Board still point to an upcoming recession. Although these indicators flashed recession last year and were defied as the economy continued to grow, there are renewed concerns as mortgage rates reach new highs. One of the Leading Economic Indicators is Building Permits for New Private Housing that are still well above post-2008 housing crisis levels but face uncertainty in the high mortgage rate environment.

Building Permits for New Private Housing

(In Thousands of Building Permits for New Private Housing per Month)

Source: The Conference Board