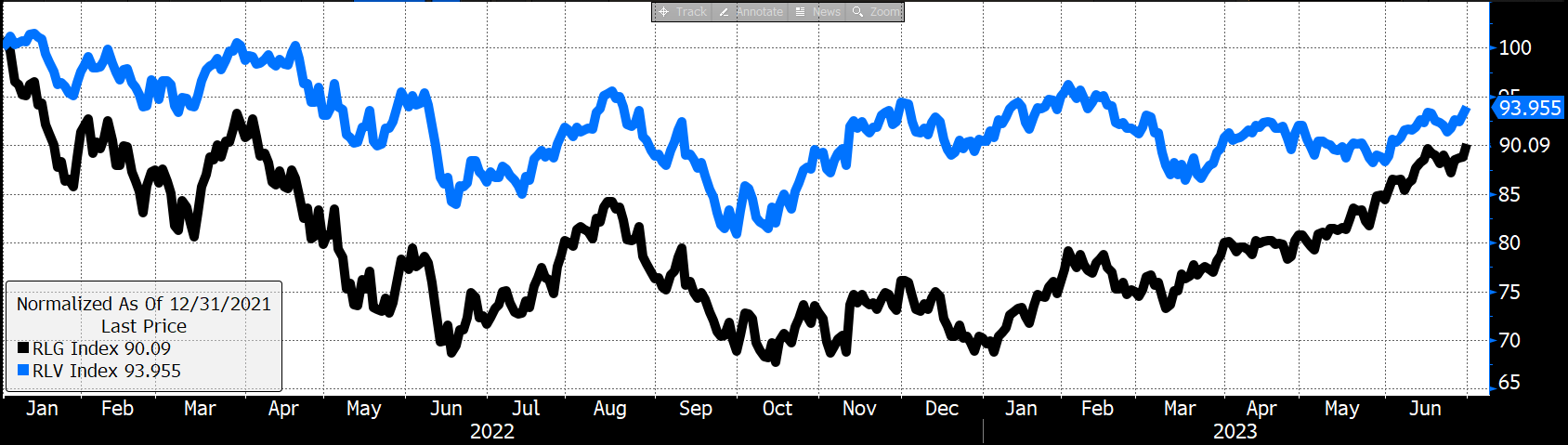

The overall equity market fell materially last year in the rising interest rate environment but recovered year-to-date as interest rates have since leveled off with inflation rates normalizing. Growth oriented stocks that drastically fell in price in 2022 have been the market leaders in 2023. Value oriented stocks outperformed last year but have underperformed on a relative basis this year. This is evident by comparing the Russell 1000 Value index that has a total return of 5.5% year-to-date compared to the Russell 1000 Growth index that has an outsized total return of 29% year-to-date.

That said, the Russell 1000 Growth index still has a negative total return of -9% from the beginning of 2022 through the first half of 2023. As the Russell 1000 Growth index embodies companies with high growth expectations, their stock prices have greater volatility with the changes in those expectations. Value oriented securities by comparison offer more stability with less price volatility and less downside risk.

Growth Index (RLG) vs Value Index (RLV) from 12/31/2021 to 6/30/2023

Source: Bloomberg, normalized at 100 on start date

As inflation has normalized with the Consumer Price Index at 3.0%, down from last year’s high of 9.1%, there is now a consensus we are at peak interest rates which may set up a recovery in high dividend paying stocks such as utilities. On the fixed income side, short-term corporate bonds issued by companies with strong balance sheets still offer attractive risk-adjusted returns. Our fixed income investments are mostly in corporate debt with a credit rating of A or above offering more certainty to their future coupon and principal payments.

Current Challenges:

- The Russian war with Ukraine continues on and is not expected to end anytime soon which may lead to economic surprises including supply disruptions from the commodity rich nations.

- Market-weighted indices are currently being driven by a concentrated set of stocks, as Apple, Microsoft and Amazon make up over 12% of the S&P 500 index, decoupling “market returns” from the economy.

- Highly politicized environment as we enter the 2024 election contest with a divided government.

Current Opportunities

- Inflation has normalized again dropping to an acceptable rate and setting up peak interest rates.

- The unemployment rate is still very low at 3.6% although there have been layoffs in certain sectors including from “Big Tech” companies.

- The probability of an economic recession this year has been reduced, defying previous consensus expectations from economists and leading economic indicators.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities.