Market Factors and the Year Ahead

While overall interest rates dictate the price paid to borrow money, the change in interest rates have been driving stock market returns with rates having reached an inflection point this past quarter.

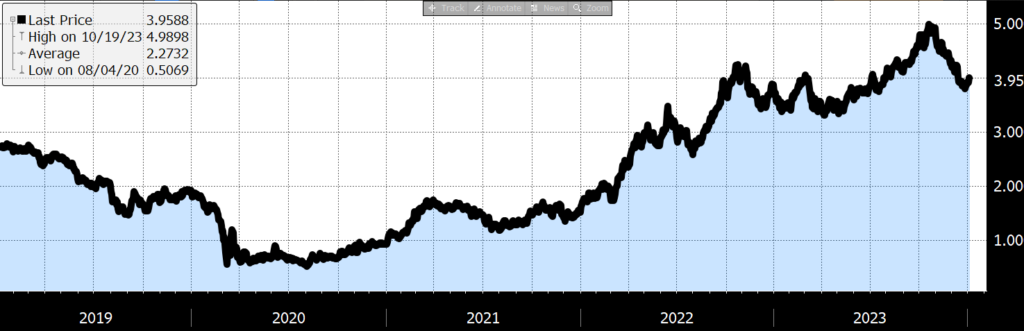

The yield earned on 10-year Treasury bond which reached a high of 4.99% in October only to close out the year much lower at 3.88%. The steep decline in the borrowing rate was the market catalyst that provided the S&P 500 stock market with a total return of 11.7% in Q4 of 2023.

The S&P 500 Index Rallied 11.7% in Q4 of 2023 as Interest Rates dropped from their Peak

Source: Bloomberg

There are two main reasons for interest rates to be correlated with stock prices: 1) The absolute interest rate impacts a company’s earnings as the higher their borrowing costs, the lower their earnings and 2) portfolio rotations between equity and fixed income asset classes. Investors’ appetite for risk increase when they are not earning as much on “risk free” federally backed Treasury bonds and rotate their assets into higher yielding equities. Lower interest rates can lead market speculation on how expensive stocks will be as their price to earnings multiples increase.

The 10-Year Treasury Yield Dropped Dramatically after Peaking at 5.0% in October

Source: Bloomberg

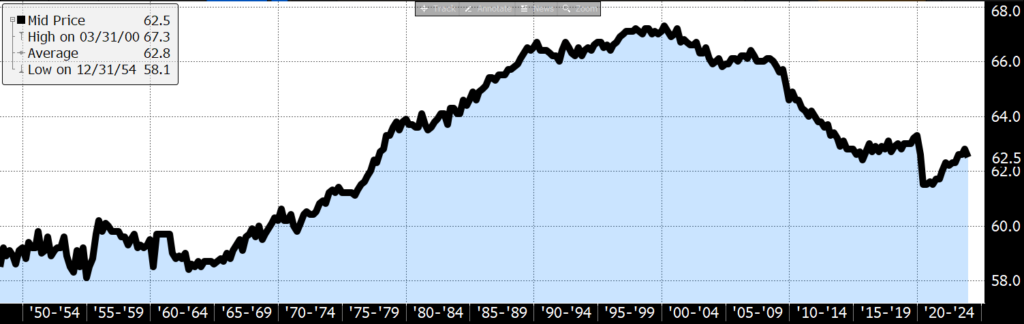

The US labor market remains strong driving high levels of consumption although accompanied by some credit concerns. The unemployment rate dropped to 3.1% and labor participation rate ticked upward back to Pre-Pandemic levels at 62.5%.

The US Labor Force Participation Rate has ticked Upwards from 2020

Current market factors including inflation, interest rates and the unemployment rate led to strong investment returns last year. However, leading economic indicators such as the yield curve inversion, leading credit index and average consumer expectations point to an upcoming recession. In the year ahead, investors would be wise to balance their portfolio expected returns with their downside associated risks.

About John G. Ullman & Associates, Inc.

John G. Ullman & Associates, Inc., was founded in Corning, N.Y. in 1978. The firm is a Registered Investment Advisor (RIA) registered federally with the Securities & Exchange Commission*. As an independent, fee-based investment management firm JGUA provides comprehensive wealth management strategies and services to their clients. The firm manages over $1 billion in client assets, with a staff of more than 75 employees over four locations, including Horseheads, N.Y., Rhinebeck, N.Y., Charlotte, N.C. and Corning.

If you are interested in learning more about how JGUA could help you, visit our website HERE, or call 1 (800) 936-3785. You can follow us on, LinkedIn, Twitter, Facebook, Instagram, YouTube and The JGUA Blog.

*Registration does not imply a certain level of skill or training