In the ever-changing world that surrounds the stock market and economy in general, the team at John G. Ullman & Associates is committed to keeping you informed and up to date on the latest news and events that could affect you!

Each month, Mark Abdalla, CFA®, MBA, will recap the news and events that led the news cycle around the market – in addition to giving his take on what lies ahead.

Are we at Peak Interest Rates?

The Federal Open Markets Committee (FOMC) raised their benchmark federal funds rate by 25 basis points to 5.00% this week. The key question for investors right now is this: are interest rates at their peak for this economic cycle or will the Federal Reserve continue to raise rates?

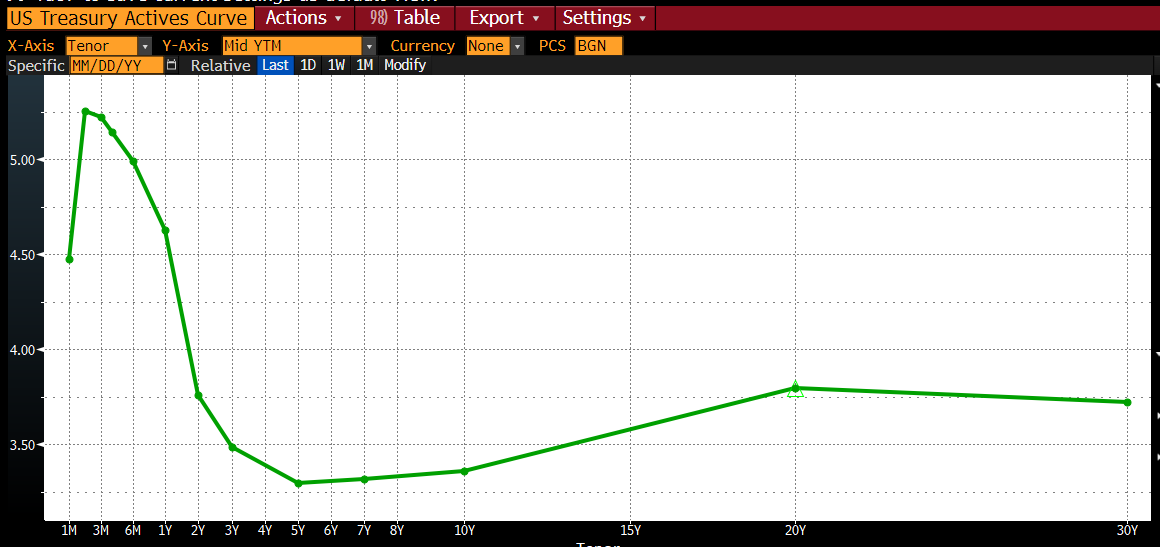

This is going to be dependent on incoming data but the market is currently pricing in peak interest rates as the bond yield curve (Yield on the Y axis and Time to Maturity on the X axis) is negative sloping. Under the Pure Expectations Theory, a negative sloping yield curve indicates investors expect interest rates to decline over time.

You can see from the Treasury Yield Curve below that the three-month Treasury Bill is yielding 5.2%, while the five-year Treasury bonds are yielding a far lower 3.3%. This is an indication that interest rates will come down over the next 5 years. One event that would make interest rates come down is an economic recession.

US Treasury Yield Curve

Leading Economic Indicators

The downward sloping yield curve is a leading economic indicator with a strong track record of preceding an economic recession. This is essentially because recessions are deflationary and force interest rates downwards.

Other leading economic indicators are:

- The stock market as defined by the S&P 500 index

- Leading Credit index.

- Average Consumer Expectations for Business Conditions

- ISM Index of New Orders

- Building Permits, Private Housing

- Average Weekly Hours in Manufacturing

- Manufacturers’ New Orders, Nondefense Capital Goods excluding aircraft

- Manufacturers’ New Orders, Consumer Goods & Materials

- Average Weekly Initial Claims in Unemployment Insurance

Although the data indicating a recession is mixed with the S&P 500 index up 6% year to date, after dropping 18% last year, these leading economic indicators on an aggregated basis point to an upcoming recession.

The one saving grace for the economy is the low unemployment rate of 3.5% that has led to strong consumer spending, even though consumer expectations and credit scores have dropped.

If there is a recession, our opinion is that it will be a “soft landing” accompanied by a strong monetary response as embedded by the downward sloping yield curve.