Market Drops…Now What??

*Spoiler alert…..no need to panic.

It’s been a Volatile week in the Markets. Sharp declines, and the dramatic headlines that follow, can trigger panic and feelings of uncertainty, especially after the record breaking growth that’s been seen in the Market over the last year.

What caused the drops seen in the Market over the last few days?

The economy overall has been doing pretty well. So the correction could be due to fears that growth will result in higher interest rates and the Fed tries to adjust for inflation. It may seem counter intuitive, but positive jobs numbers released on Friday were likely the trigger. Wages are on the rise after years of decline…this is good news for the economy, but may have spooked investors.

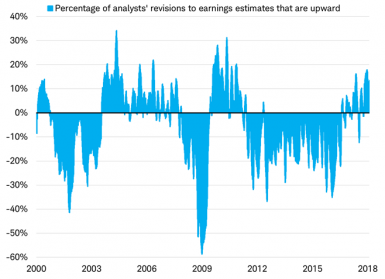

Analysts are raising earnings forecasts after years of lowering them

Chart depicts upward less downward earnings per share estimate revisions by analysts divided by the total number of revisions for companies in MSCI World Index. Source: Charles Schwab, Factset data as of 2/2/2018.

It’s great that the Economy seems to be doing well…but how can I be sure my investments are doing well when there is a Volatile Market?

Uncertainty leads to questions. That’s to be expected. At John G. Ullman & Associates, Inc. moments like this reinforce our philosophy of balance.

In order to explain how our Balanced Philosophy serves our clients well in times of volatility in the Markets, we went straight to our President and Founder, John G. Ullman to answer questions like this.

As the Market has continued to grow over the last year, it was inevitable there would be some corrections eventually. Of course, we never know when that time will come. Is there anything we’re able to do to protect our clients from the inevitable drop?

“As a summary, market valuations have been at elevated levels and been moving higher. Our disciplines and analytical processes include having Buy and Sell (including partials of all positions) targets on each stock on our Buy List.

A number of issues have reached Sell prices, especially in the most recent 8 months; as a result, most accounts have recently been more Conservative than typically.

Based on high equity valuations, we have been increasing the percentage of certain “out of favor” issues as well as Infrastructure, more generally. For the “out of favor” category, at currently reduced price levels, we are intending to make purchases on issues that are currently reduced, as we expect with corrections their value will rise again. We essentially have no “retail” exposures and have been increasingly selective as valuations have become elevated during this positive period for our (and generally worldwide) economy(ies).

Bond interest rates continue to be historically low but have been moving higher. With the difference between Treasuries for 2 and 30 years being slightly under 1%, the short term maturities in Clients’ accounts greatly insulate and protect against the potential risks from rates going higher.” –John G. Ullman

Bottom line? Times like this are a great reminder of why we do what we do. Our team proactively monitors clients’ investments and makes adjustment to maximize earnings potential while minimizing risk. Our Advisors establish deeply personal relationships built on values and trust, which allows them to work on behalf of their clients in a meaningful way. Our balanced philosophy has served us well for almost 40 years, and in moments of uncertainty, balance offers a steady hand when things seem volatile otherwise.

For more information about John G. Ullman & Associates, Inc. please contact us , or email [email protected].