Target Date Funds Explained

By Mason Jones, CFP®

Target date funds (TDFs) have been around for over two decades. These funds are meant to help investors simplify their decision-making in how to allocate and diversify their assets, especially as they get closer to retirement age. The funds are created by a specific mutual fund company (e.g. Vanguard, PIMCO, BlackRock, Fidelity, etc.), who will then take 12-18 of their mutual funds and create a diversified portfolio with the intent of helping investors avoid inappropriate investments.

How It Works

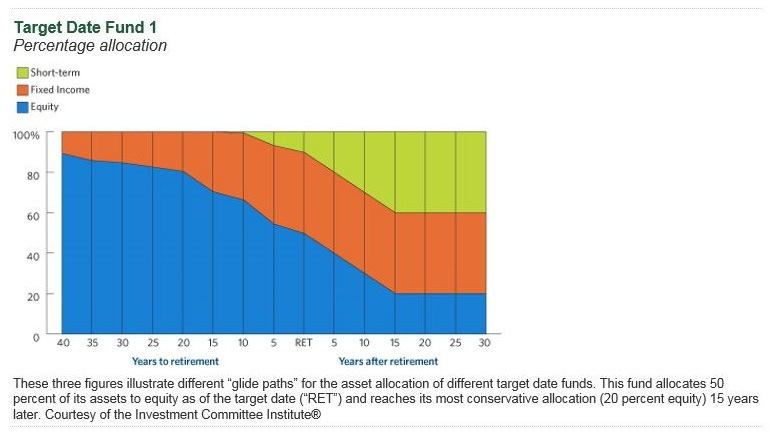

TDFs are essentially a “set-it-and-forget-it” option. As you get closer to your “target date” of retirement, the fund will start shifting more conservative (moving from less stocks to more bonds). For instance, an investor who plans to retire in 2030 would have a lower percentage of risky assets such as stocks and more conservative assets such as bonds compared to someone retiring much later in 2055.

Why Do They Exist?

The Pension Protection Act of 2006 helped fuel the popularity of TDFs. If a plan participant did not select an investment within their 401k the company could direct the participant’s assets into a TDF and not be liable for any potential losses. Offering only TDFs or making them the default investment is an easy out for the plan administrator because the federal government has approved TDFs as acceptable choices.

Benefits: TDFs allow investors to be on “autopilot” and have several features that simplify life by attempting to avoid common investment mistakes which include:

- Unsuitable diversification across asset classes (invest in a mix of stocks, bonds, and cash).

- Extreme asset allocations (i.e. a young worker invests too conservatively, or someone nearing retirement investing too aggressively in stocks).

- No re-balancing (periodically adjusting your allocation back to normal after market swings).

- Automatic adjustment for changing risk profile (ex. a shorter time horizon leaves fewer chances to make contributions to savings and has a greater sensitivity to market swings).

Simplification is a viable option for those who have a modest investment plan that does not require much interaction, however, TDFs aren’t always a one-size-fits-all investment option. Outlined below are several potential downsides and reasons why I feel TDFs fall short for most investors.

Where and Why They Fall Short?

The primary issue here is that many investors may be invested inappropriately for their age, risk- tolerance, or financial situation. Are TDFs the solution to these problems? In my opinion, no.

Choosing a fund based on the date of expected retirement seems like a very logical thing to do. The truth is TDFs allocate assets based on what the fund managers believe is the best asset mix for the average individual planning to retire at a specific time. Many people spend as much time in retirement or longer than they spend in their working years, so getting overly conservative may not be the appropriate strategy. The bottom line is TDFs only take into account an investors age and do not factor in risk tolerance or other life situations.

Key Consideration #1: Complete Lack of Customization

TDFs are less effective than the personalized approach, which is what JGUA has been practicing for over 40 years. Most, if not all, of our clients require a custom solution that takes into account not just what they have in their current employer plan, but also their entire asset picture including other IRAs or spousal retirement accounts, and non-retirement investment accounts.This matters because individual life changes and events happen, which may impact your ability to save. Someone who picked a target date fund, because they had a later retirement date in mind might end up retiring much sooner. This will leave them with a mix of funds that are too risky and volatile for their new lifestyle.The main takeaway here is that retirement planning is a very complex process and cannot always be reduced to simply choosing a retirement date and a fund based upon that date. A tailored solution is far more likely to help you achieve your goals than a one-size-fits all solution.

Key Consideration #2: Lack of Clarity and Security Overlap

TDFs on average have approximately 15 underlying funds and those funds often reflect a variety of asset classes ( stocks, bonds, cash), objectives (growth, income, or growth and income funds), and strategies. The underlying funds often are segmented based on regional exposure including domestic, international, emerging or global markets.This is important because the numerous combinations and allocations among underlying funds often create securities overlap despite their asset classes, strategies and regions. For instance, a value manager may be buying one stock when a growth manager may be selling. This will result in uncoordinated portfolio decisions. In other words, you could have a very high concentration in a particular company or industry. This happens because funds with different investment objectives still may invest in the same securities.

Ask an advisor who has your best interest in mind to “X-ray” your portfolio for any overlap.

Key Consideration #3: Fund Managers

When it comes to TDFs you already know to look under the hood at the underlying investments, because most of the information that is provided is written to meet regulatory requirements. Here’s a few things to be aware of while the hood is open…

In most cases, it takes 10 years before a track record is long enough to say whether a manager has exhibited investment skill. With that said, mutual funds change managers all the time, but they keep advertising the fund’s track record just the same.

TDF managers often select funds solely from one mutual fund family, and that can include historically under performing funds. Additionally, the broad diversification in a TDF may work against an investor if only a few narrow segments of the stock market are driving up the overall market. Lastly, concerns have been raised that a manager may feature an under performing or newly launched fund for business rather than investment reasons.

Which Strategy is Best for You?

Everyone is different, so it really depends on your specific situation and what side of the active vs. passive management side of the fence you fall on. You could potentially miss out on capturing short-term market opportunities by investing in passively managed index funds, such as Vanguard’s target retirement funds, because an active manager is constantly monitoring market conditions. Find an Advisor who will construct a personalized plan tailored to your family’s dreams, goals, and aspirations.